The Digital Mandate: Why Banks, Multi-State Co-ops and Patsansthas Need Digital Marketing

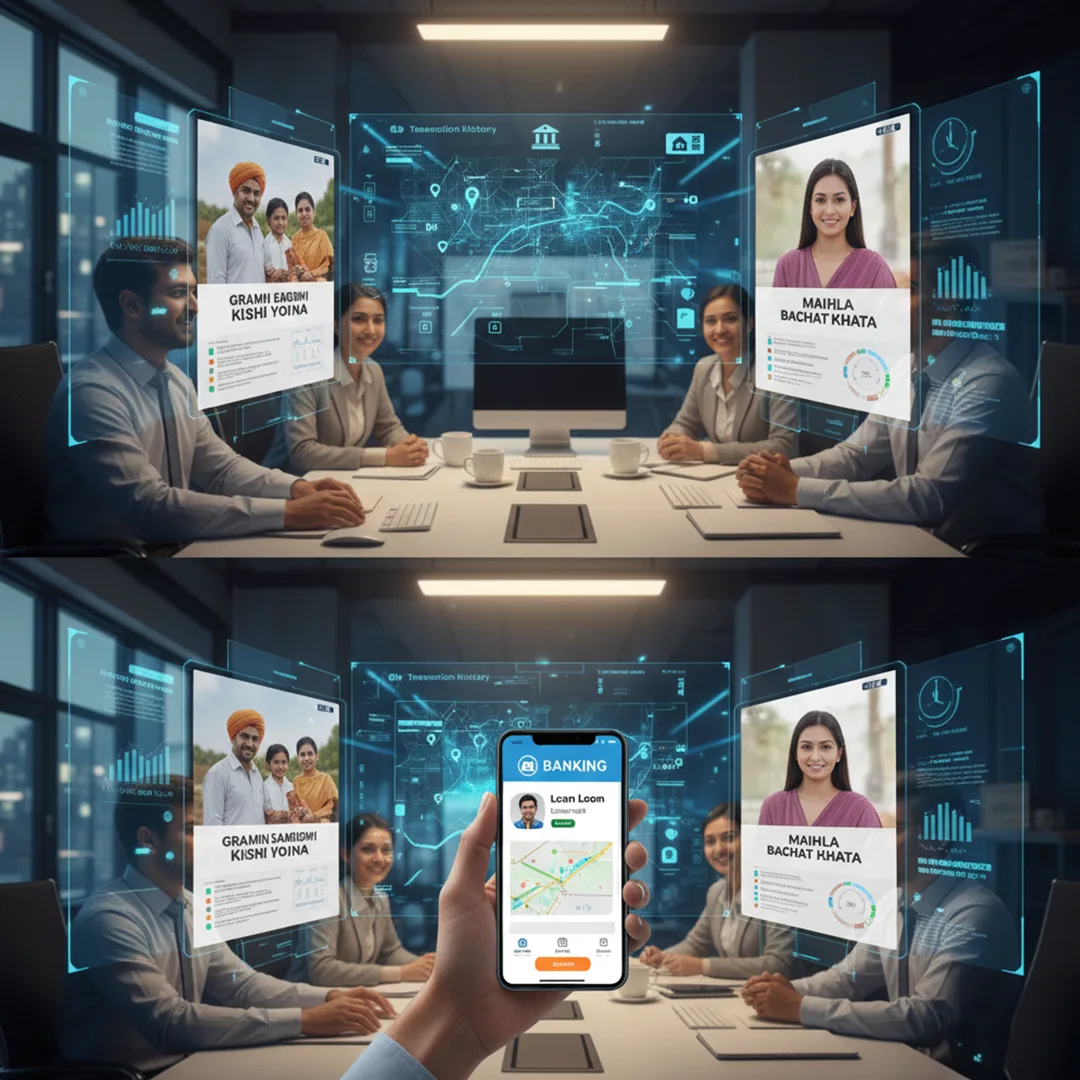

Digital marketing is no longer optional for financial institutions like banks, multi-state cooperative banks (multi-state) and credit societies (patsansthas); it is a fundamental requirement for survival and growth. These institutions, regardless of size, must navigate a hyper-competitive, trust-driven and increasingly digital customer landscape.

1. Reaching the Modern Customer

Today's consumer, whether in an urban center or a rural town, starts their financial journey online.

- Expanded Reach: Traditional institutions are limited by their physical branch network. Digital channels like Local SEO, paid advertising and social media allow a small patsanstha or a multi-state co-op to effectively target customers far beyond their immediate locale, reaching new markets cost-effectively.

- Mobile-First Banking: With nearly all customers using mobile banking apps, the marketing must follow. Digital channels ensure the institution is present where the customer spends their time, providing a seamless, mobile-optimized experience.

2. Building Trust and Educating

Trust and transparency are the cornerstones of finance and digital marketing is a powerful tool to build both.

- Content Marketing: Financial products can be complex. Blogs, videos and infographics simplify topics like loan applications, savings schemes and investment products, positioning the institution as a trusted financial advisor.

- Transparency and Security: Digital platforms offer continuous opportunities to showcase security protocols, regulatory compliance and positive customer testimonials, which are crucial for overcoming the public's natural skepticism towards new financial services.

3. Competitiveness and Personalization

Financial institutions face fierce competition, not just from each other but from nimble FinTech startups.

- Targeted Products: Digital marketing allows for hyper-targeting. Instead of generic newspaper ads, an institution can use data to promote a specific farmer loan scheme only to farmers in a particular district, maximizing the Return on Investment (ROI).

- Customer Engagement: Unlike one-way traditional advertising, digital channels (email, social media) facilitate two-way communication, allowing the patsanstha or bank to answer queries instantly, personalize offers and improve customer experience, which directly enhances retention and loyalty.

In essence, digital marketing provides the precise, measurable and engaging tools necessary for financial institutions to expand their community, solidify trust and remain relevant in the age of instant, online transactions.